TL;DR

The Big Idea: OpenAI's New Love: Ads - Sam Altman is trading pure innovation for advertising, proving that even an exponential growth rate must eventually pay the piper.

This Week in the Watson Weekly eCommerce Digest - Sam Altman testing ads, Lowe’s to license its checkout, AI meets Davos and a Jassy sighting, and Claude Code is having a viral moment.

PayPal Buying Cymbio - PayPal is spending $200 million to build the "agentic plumbing" for AI shopping, betting that the future of commerce belongs to bots, not buttons.

What We’re Watching This Week

Wednesday, January 28th: META Earnings

TOP NEWS OF THE WEEK

THE BIG IDEA: OPEN AI’S NEW LOVE: ADS

OpenAI and Anthropic have no analogs as companies, as they have grown faster than any company in history.

Remember the Keanu Reeves movie "Speed. We now have Sam "Adman" driving the advertising bus.

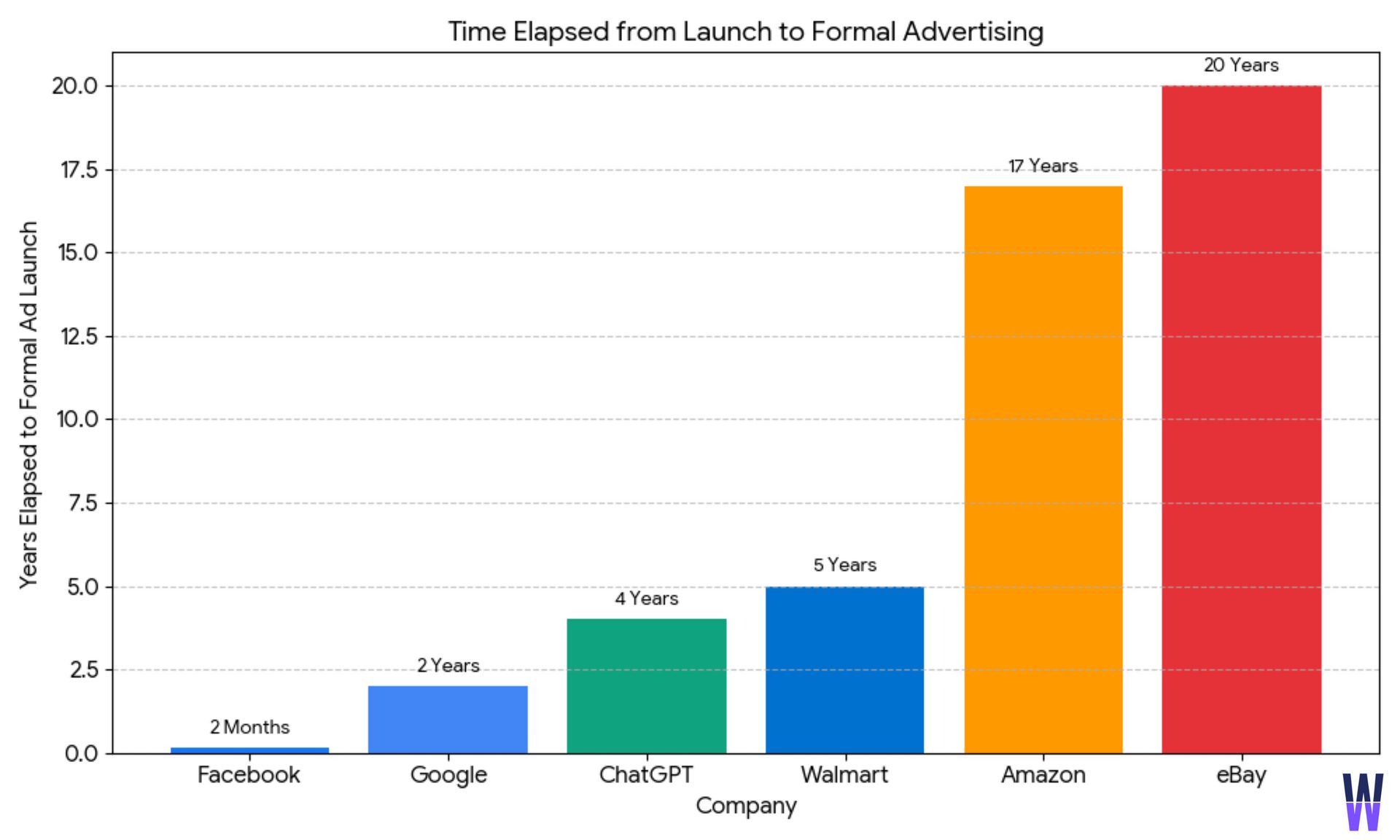

Amazon, Google, Walmart, and eBay all took between 2 and 20 years to add advertising to their platforms.

Will advertising impact paid users? Asking for a friend.

Everyone eventually sells advertising online. It's one of those laws of the internet. Even if you despised it as vehemently as Sam Altman did. When you raise billions of dollars from investors, you will need to start paying the piper; otherwise, the capital will dry up.

But let's start by taking a step back.

It feels like ChatGPT has started testing ads on its platform, but compared to Facebook, Google, Walmart, Amazon, and eBay, it's clear that they are not the fastest to add ads. I know it's not apples-to-apples, but aside from eBay and Walmart, these are the juggernauts Sam Altman is competing against. Facebook (a part of Meta) offered low-cost ad slots two months after launch. Remember, it was “thefacebook” then, and ads were supposed to make it not cool, according to Zuck. We continuously forget that every company is a unique entity at a different lifecycle stage, unless you are Amazon, which seems to continually disrupt itself.

Advertising is the highest-margin business model any company can add to its revenue opportunities, but I believe it should be pursued only after all other opportunities have been exhausted. Why? Once you sell ads there is no going back. You are changing the customer experience - either making it worse (Amazon is the prime example of this) or raising questions over bias and accuracy of the results being generated by technology.

In other words, trust is paramount and cannot be regained after it is lost. We all learned during the Google advertising lawsuit that, as much as Google wants us all to believe, they operate a black box with no visible knobs in cases where executives had the opportunity to impact results.

It's yet another sign that shows the differences and access to capital at the times these companies were founded. So, can you really compare these companies to one another, or does this show investors' desperation to find a new opportunity that could generate significant revenue? I dunno.

It is increasingly clear that comparing companies like OpenAI, Anthropic, and others to incumbents is like Icarus flying close to the sun, hoping the sun will not melt his wings. These companies have raised capital at levels that make them borderline too big to fail, but it also requires Sam Altman to morph into Sam "Adman" to ensure that they can generate enough revenue amidst record capital burn. Imagine burning through $8-$12 billion in this current economy. Are there any analogs for entrepreneurs or executives to think of? Agentic, whatever that is, is not going away in 2026.

ChatGPT will test advertising with logged-in customers on the free or Go (a new option) plans. They claim to be doing this “thoughtfully,” but the company expects advertisers to commit $1 million on CPM ads during this test. Why would anyone feel the need to throw $1 million into an unknown advertising system?

Do you remember watching the classic movie: “Speed?” Keanu Reeves and Sandra Bullock on a bus heading into the city, being watched by a crook via video. Altman reminds me more and more of Reeves, and of the need for a third party to get him and others off the bus and into a place where they can get help.

THE BOTTOM LINE

Sam's sudden change of heart raises more questions about OpenAI's governance. Who precisely is driving this bus?

THIS WEEK IN THE WATSON WEEKLY ECOMMERCE DIGEST

Sam Altman Testing Ads

Lowe’s to License its Checkout

AI meets Davos and a Jassy Sighting

Claude Code is Having a Viral Moment

THE TRUTH ABOUT LAST WEEK: PAYPAL BUYING CYMBIO

PayPal has a muddled identity and continues to pursue opportunities that complement its core business, payments. The company does still feel like it suffers envy on multiple levels: Shop Pay in one direction, Visa in another, and Amazon in a third. Side project much?

Cymbio, an Israeli company, previously received investment from venture capital funds, including PayPal Ventures, which likely indicates that PayPal likes what it saw from the technology firm.

Cymbio is being acquired for a single product that helps brands get their products inside LLMs rather than its core services of enabling connectivity for suppliers to marketplaces and other channels.

Who wants to be the plumbing of agentic commerce? (PayPal raises hand excitedly!!) PayPal not only seems miffed from all the Shopify love from Google, but has previously expressed interest in helping consumers with their shopping journey. To do this, it will need a reliable source of product data and order plumbing — which it lacks... until now.

PayPal acquired Cymbio last week for an undisclosed sum, reportedly $150-200 million, to offer agentic services to merchants. This echoes PayPal's 2021 acquisition of Happy Returns ($275 million). Both startups received investment from PayPal Ventures. Cymbio, which raised $35 million in VC funding, was acquired four years after PayPal Ventures' investment.

Cymbio integrated merchant catalogs into LLMs prior to the acquisition and was not acquired for its original dropshipping solution. Notably, Cymbio customers used PayPal-enabled checkout for agentic commerce on platforms like Microsoft Copilot and Perplexity, not the most-adopted LLMs (ChatGPT and Google's Gemini).

WHY IT MATTERS

PayPal is betting $200 million that the future of shopping isn't humans clicking "Add to Cart," but AI agents autonomously purchasing products via background data feeds. By owning this "agentic plumbing," PayPal transforms from a simple checkout button into the essential infrastructure for an AI-driven economy.

WEEKLY LOOKAHEAD

WHAT WE’RE WATCHING THIS WEEK

Wednesday, January 28th: META Earnings

We are starting to get ready for earnings season. First, on Wednesday, Meta will report earnings. The questions that are top of mind:

What will be the investment in AI?

Will we see ChatGPT taking marketing dollars from Meta?

When will Reality Labs (which makes the popular Ray-Ban sunglasses with cameras) start turning a profit? (Don't hold your breath on this last one.)

NEWS WE’RE LOVING

China, US sign off on TikTok US spinoff: Is TikTok US finally being spunoff with all parties happy? Asking for a friend

WATSON IN THE WILD

Highlights and sizzle from our latest NRF 2026 Watson Weekend Live! event on January 11, 2026, presented by Radial: What is Important in 2026?

UPCOMING EVENTS

Webinar: January 29th at 12:30PM ET - NRF 2026 Recap: Agentic Hype and Complications with Rick and Nick - Register Now. Missed NRF? Tune in for this debrief.

Shoptalk 2026: Join us for the Watson Live! — Agentic Debate Series Lunch at Shoptalk Las Vegas 2026 - Register Now. Another debate? Come see what craziness we have cooking up for you at Shoptalk.